Investing to Advance Racial Equity

Investing to Advance Racial Equity

Practical ways to tackle economic inequality

Tweet

Cornerstone Capital Group

Impact Investing SDGs

Reports

Sep 2018

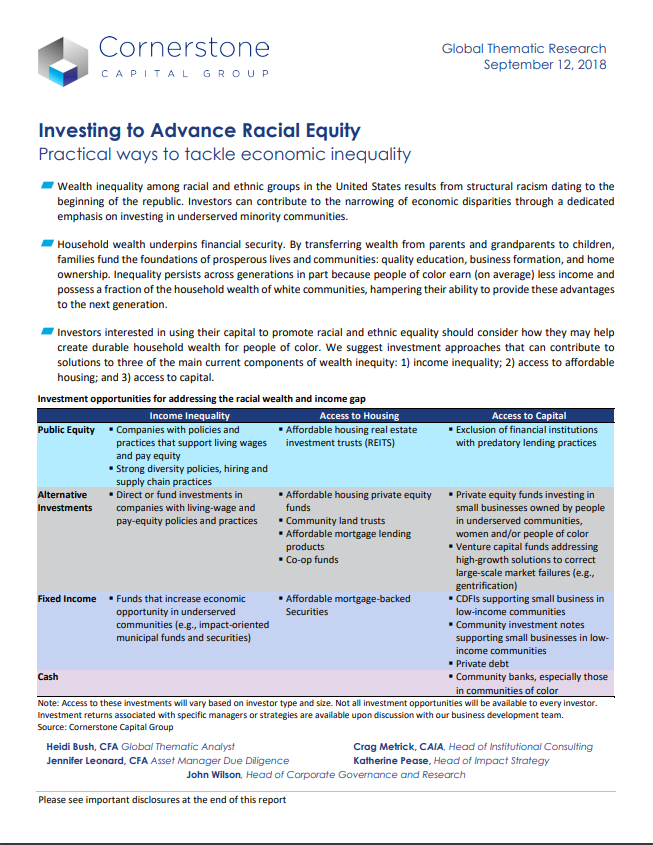

The report assesses how investors can contribute to solutions for three of the main current components of wealth inequality: income inequality, home ownership and affordable housing, and access to capital. Investors cannot, on their own, undo centuries of inequalities caused by structural racism, but they can help build a fairer and more just economy.

In the report, Cornerstone Capital Group evaluated how investments can help break the cycle of racial and ethnic wealth inequality. A few possible solutions include:

- Investing in deposits at Community Development Financial Institutions (CDFIs) will help those institutions invest in underserved communities through affordable commercial, consumer, and mortgage loans.

- Fixed income or alternative funds focused on impact in underserved communities can provide reasonably priced loans for businesses or commercial properties in neighborhoods of color

- Through crowdfunding, investors can help repair household balance sheets of overleveraged individuals by swapping high-cost consumer, educational or mortgage loans for restructured, affordable, lower-cost loans.